As always, Avinash Kaushik does an excellent job of explaining complex ideas in simple terms. Thank you Avinash and the following article focusing the marketing web analyst is another one (of many) must reads from Occam’s Razor.

The Biggest Mistake Web Analysts Make… And How To Avoid It!

The single biggest mistake web analysts make is working without purpose.

The single biggest mistake web analysts make is working without purpose.

We work very hard. We torture SiteCatalyst. We send out a lot of data. Then we resend it again and again. And yet our work results in very little impact on the business in terms of action taken by company leaders.

Why this sad state? Almost always we dive into the ocean of data first. Sadder still, we don’t ask questions later. We never ask questions.

No questions. No tie to what’s important. No impact from the data.

Result? Our work lacks purpose. It is that simple.

My normal recommendation to address this supremely corrosive issue is to encourage each company to go through the process of creating a Digital Marketing and Measurement Model . It is a fantastic five step process that forces the engagement of key stake holders to produce a blueprint of why digital exists in a company, and what it is trying to accomplish.

No touching Google Analytics. No going to web analytics conferences. No tweeting for help.

Just doing the four things, in five steps above, will deliver what we lack… purpose.

Unfortunately a very tiny fraction of companies, or Analysts, want to put in this lifesaving effort up front.

If you fall in the “Analyst unwilling to do the hard work” category, I’m afraid I can’t help you.

If you fall into the “Analyst really wanting to do the hard work but does not have the connection to Superiors, or other teams, and looking for any way out to identify business purpose” category. I have a very very simple approach for you to follow. You are going to love it.

But there are two prerequisites: 1. You are going to have to throw away the shackles, and think like a business owner. Even if you work in a multi-headed hydra called “global corporation.” 2. Have the courage to move beyond the office politics/bickering, move from waiting for a savior to tell you what the purpose should be to investing some time in figuring it out yourself.

If you meet the prerequisites, and have a pinch of business savvy, we are together going to change the world!

My recommendation calls for you to take a structured approach and answer five questions. The insightful answers will help you create your own understanding of the purpose of the digital existence. You’ll end up creating something very close to the DMMM above.

The result will be an astonishingly high level of focus for your digital analytics work (even on day one) and hyper-relevant insights to the business. That, in turn will simply blow people’s mind (relevant insights always do), creating love for you. And love like that is hard to come by. (Conveniently that type of love also translates into a sweet raise. 🙂

Perhaps I’ve over-promised. But I’m just so excited about this process and its power to make our professional lives better.

Ready?

In my experience the best teaching happens with real world examples, rather than spouting theory. Hence, I’m going to useCredit Karma as an example to illustrate the process. I don’t know anyone at Credit Karma. I’m not an expert in the credit score reporting business. So I’ll be just as blind as you might be walking into any business and going through this exercise.

Here are the five questions (plus one special bonus in the end) I/you have to answer to get a very good sense of the business to bring astonishing relevancy to our data analysis:

#1. Why does the site exist?

This is the holy grail. But here’s the trick: We are not looking for just the obvious answers. We want to identify as close to 100% of the purpose for which the site exists, how it makes money/gets leads/raises donations (as the case may be).

In the case of Credit Karma my first job is to identify what the Macro Conversion is. The single biggest reason for the site’s existence.

Luckily except in the case of the most incompetent websites, this is easy to find. In our case it is right there staring us in the face on the home page: Free Daily Credit Card Monitoring!

Just to be sure, since I don’t know them at all, I might poke around a few pages to make sure. But usually it is pretty clear.

And in this case the cool thing is that they give you one score, the TransUnion one, for free. No credit cards required to sign up! My favorite report is the Credit Report Card. Great visualizations and really great data. Sign up today! [Disclosure: I’m not affiliated with nor do I know anyone at Credit Karma.]

OK, back to being the business owner.

The next thing to answer this question, and ensure that I’m not a newbie Analyst who will only focus on 2% of the business success, I have to figure out the Micro Conversions.

To do this you’ll go to the main sections of the website. You’ll look for other calls to action. “Sign up for the mailing list.” “Order our catalog.” “Download the trial version.” Et al.

After 10 minutes of browsing, I found all these valuable Micro Conversions:

Some are pretty straight-forward. Affiliate links (Take Offer, Compare Rates) that link to other sites from which Credit Karma makes commissions. Advertising on the site is a Micro Conversion (the SavvyMoney ad above with the link Manage Your Debt). The Write A Review call to action (the more reviews there are on credit cards, the more valuable the site is for comparison shoppers the more people will come and do business with them). In the same vein, completed Compare Credit Card offers is an important Micro Conversion (and a sign of deeper engagement with the site). Finally, the links to connection on social platforms are Micro Conversions as well.

Now you have a fantastic understanding of the business objective (make money via credit reporting) and the Goals (a combination of Macro + Micro Conversions).

And, I can’t stress this enough, you are not just looking at 2% of business success, you are looking at 100%.

Bonus: Identifying Macro and Micro Conversions also gives you a list of Ecommerce Tracking to set up on the site, and Goals to set up in the Admin interface. You’ll also note small things like outbound link tracking (using Events) to set up for social actions and ensuring all affiliate links are tagged with our company’s tracking parameters.

Don’t open Google Analytics or Yahoo Web Analytics yet! We have more work to do…

#2. What parts of the website should you focus on first?

One of the biggest problems we have with digital analytics is that we have waaaaaay too much data. And because the reports only show the top ten rows, we might not easily be able to see what matters.

Hence it is very important to figure out where to focus your analysis first. My method for doing that is to browse around the site and answer this question:

~ What content on the website is directly tied to driving Macro and Micro Conversions?

~ What sections of the website might be most valuable to the visitors?

~ What content areas seem very expensive to create (hence more important to measure if they are adding any value!)?

~ What cross-sells and up-sells do you see being pimped across the site?

~ What does the top nav and left/right nav groupings tell you about priorities?

You can quickly see how those simple questions help you understand what data might be the object of your analytical horsepower.

Another 10 or 15 minutes of exploring various links and pages yields the answers I’m looking for.

For me, as a lay person and not a credit score industry veteran, the most important section would be /learning. The more the website visitors are aware of how important credit scores are, the more likely they are to sign up.

This was a bit hidden but the second most important piece of content would be the Credit Simulator (/preview/simulator). I can go play with the simulation and be informed (scared, actually) of the implications of taking credit and become a more qualified lead for Credit Karma.

The other sections I found valuable, using the framework outlined in the questions above, were: /help/howitworks (no one would sign up without looking at this page, we have to A/B and MVT test this to the max), /tools (this creates a great affinity for the brand, even if people don’t sign up) and of course /creditcards (if they don’t sign up, let’s at least get an affiliate click :).

You can quickly see how you’ve got a short list of things to do in the Content section of Google Analytics. The filters to apply to those reports, to understand which KPIs would be most important as you value this content.

Rather than letting the data take you somewhere randomly, let this approach put you in the drivers seat and then you take data for a ride to a specific destination. That is what being successful is all about.

Awesome, right?

#3. How smart is their digital marketing strategy?

If you are a regular reader of this blog you know how deeply fond I am of the Acquisition, Behavior, Outcomes framework. We covered Outcomes with the first question and behavior with the second. Now it’s time for acquisition.

What I try to probe, without talking to anyone at the company, is how savvy the company is in digital marketing. I’m also trying to figure out all the places they might be doing advertising. I want to know if they have even a simplistic understanding of how to rock social media.

Here’s my process for doing that…

~ Visit www.google.com (or Baidu in China, Yandex in Russia etc). Run a bunch of search queries with the intent of looking for the company’s products and services. I’ll do at least five or so brand-related queries (“credit karma reviews”), and at least ten to fifteen non-brand/long tail queries (“free credit scores,” “best credit score website,” “credit score reporting scams,” etc.).

I make a note of: 1. Organic search rankings (rank, page titles, snippets). 2. Paid search ads (title, creatives, urls shown). 3. Competition (who comes up first consistently, ppc and organic). 4. Search Plus Your World results.

[Also read, Analytics? Let’s Defer to Avinash Kaushik]

~ Visit sites like (in this specific case) Yahoo! News/Finance to see if I get display ads when I read articles or stories about credit cards, credit scores etc. Do the same with some of the top sites I can think of related to the industry (brokerage sites, financially savvy consumer sites, etc). Finally, checkout at least a couple of blogs relevant to the topic.

I’m trying to see if I bump into my company’s ads (display, text, any other type). It will be a great reflection of how well thought out their acquisition strategy is, or how sub-optimal it is.

~ No business, B2C or B2B or here2there, can exist without a robust YouTube strategy. So off to YouTube to do some relevant searches to see what videos show up.

Do I see any promoted videos in the results (to control the message)? Do I discover a brand channel by the company (to create a deeper connection with customers)? How lame or awesome are their videos (you want to teach and pimp both at the same time)?

~ Social is all the rage these days and I do believe that every business of every type should have a social presence that is the epitome of conversational marketing. So visiting their Twitter/Facebook/Google+ pages is critical.

Do they have a social presence? How many followers/likes do they have in comparison to their competitors? Do they reply to questions, or just shout? Do they pimp offers or try to make people’s lives better? Is there any consistency in their contribution?

One special thing I’m also checking is if they have the +1 button on their website. Search Plus Your World and the social graph has become quite important. People search now, see their friends/social graph liking/endorsing brands and pages. Those often catch the eye of the searcher more easily, sometimes, than paid or organic results.

All this goes into creating starting points for what I’ll do when I get into the web analytics tool. Will I analyze Search first or Campaigns? Will I focus more on referring sources or social traffic first? Will I measure the value of YouTube first or Display ads?

Additionally the above investigation also gives me a set of insights I can deliver to my CxOs. Channels where they should exist but don’t. Things they might be doing badly in Social or YouTube or wherever. Missed opportunities in Organic search or SPYW. Things like that. And these recommendations will come from my own digital marketing sophistication (earning respect from my Senior Leaders).

Bonus: In the digital marketing savvy section I’ve also started to pull out my Samsung Galaxy Tab and Nexus S to preview the mobile and tablet experience of the company. If it stinks that tells me a lot (remember the year of mobile was 2010!). I’ll also run a couple of quick searches on Google or Yandex or Baidu to see how the landing pages look on my mobile phone and tablet.

Super Bonus: Only for the most passionate amongst you… run a quick query in the iTunes App Store and the Android Market to see if the business exists there in the form of an application. If yes, download it. Play with it. Download some competitor offerings.

Most companies that are on the bleeding edge of digital marketing savvy are leveraging Google, Yahoo!, Email Marketing, Blog ads, Social channels AND mobile experiences AND mobile applications. The analysis above, will bring remarkable brilliance when you dive into the data. You’ll take your company from bad to good in terms of acquisition-savvy, or from good to great.

#4. How well are they doing in context of their competition?

It is almost criminal to dive into doing any analysis of a company’s website data without first getting a little bit of context about their competitive performance. Context after all is king .

Here one simple example of how it can be helpful. You log into CoreMetrics and you see a line traffic going up or down. Is that good or bad? You don’t know. No one at the company will talk to you. Why not jump on to a free competitive intelligence tool and figure out the answer for yourself?

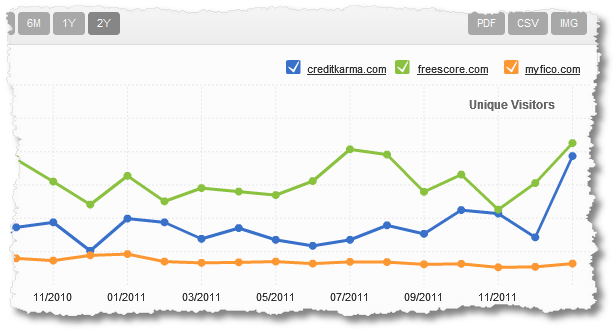

I’ll usually start with looking at the company’s data in www.compete.com (if they are US-based with primarily US-based traffic) orGoogle Trends for Websites . And in five seconds I’ll end up with a graph that looks like this:

The above data is from Compete. I’ve included not just the data for Credit Karma, but also for two relevant competitors, freescore.com and myfico.com.

Initially I was wow-ed by the spike in the blue line (Credit Karma), that is quite spectacular. But then I see that it might be an industry thing, as the competitor spiked as well. Good context.

While at Compete I can also dig into a whole bunch of metrics like Visits, PageViews, udience segmentation, and so much more.

Now, I better understand visitor acquisition.

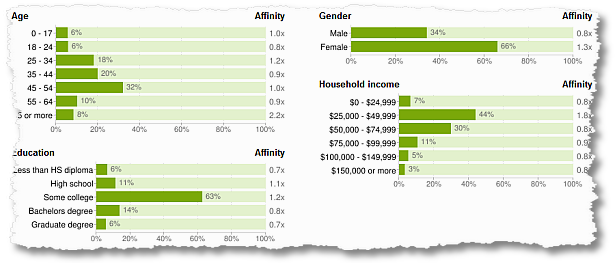

Time to understand a bit more about the visitors themselves. My BFF? Google/DoubleClick AdPlanner , perhaps the largest source of demographic and psychographic data out there.

The above data is for freescore.com. I can also quickly run queries for Credit Karma (and others) and compare and contrast the demographic profiles of people who visit the website. Are our competitors particularly stronger in some Educational categories or Incomes compared to us? What are our areas of strength?

While in AdPlanner I also highly recommend looking at “Sites also visited,” a fantastic way to understand who a site’s real competitors are. What are the clusters of options when people consider a credit report? This is also a great place to get ideas for websites you can show ads on, exchange links, etc.

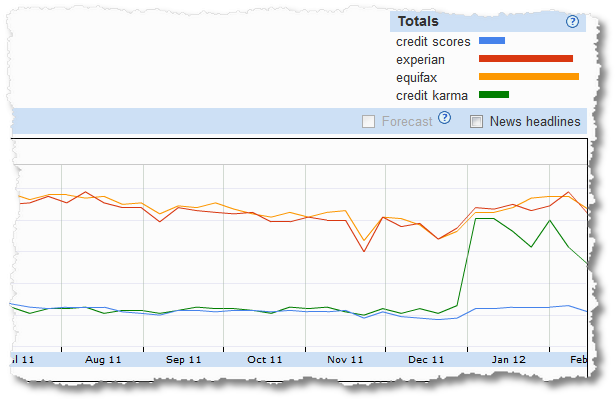

The last stop of my journey is Google Insights for Search , your direct source for all Google organic search data from across the world. Here I particularly like to look at a metric I call “share of search.” How often are people looking for the generic query for the industry, for me (/my company) and for my direct competitors?

Think of it as unaided brand recall …

Just look at that massive spike in queries for Credit Karma at the end of Dec! What the heck happened there? Great question. What where the related keywords people searched for? Check the Google Analytics reports. Was this traffic any good? Check the Google Analytics metrics. Are we going to dominate the world and crush our competitors? Time will tell!

The purpose of competitive intelligence analysis is to understand your place in the world, to highlight from an industry/ecosystem perspective what your strengths and areas of opportunity are, and to collect a list of questions like the ones immediately above for analysis in your web analytics tools.

Is that not simply orgasmic?

#5. What is the fastest possible way I can have a impact on the business?

One final thing.

I look for a low hanging fruit to fix/analyze. Something I can quickly analyze, find insights for and get fixed to show the value of data (and my employment at the company).

Here are some examples of things I consciously look for:

~ Any obviously important links that might be broken (404) or misdirected.

~ Horribly constructed landing pages for the top organic/paid keywords.

~ Something absolutely important missing from the site’s information architecture.

~ A missed opportunity for promoting a micro conversion more prominently. (Why is the Credit Score Emulator so hidden, and not on the home page of Credit Karma?)

~ Overpimping of social icons when there has never been a social post (or all posts are sub-optimal).

~ No “related items” after a product is added to cart. (Aw, come on! Has Amazon taught us nothing?)

~ 17 display ads on every single page on the website. (Why, oh why must we inflict torture?)

And other such things. Depending on the website you are analyzing, and your web-savvy/UX expertise, you might find other things. But the criteria to apply is that you are looking for big, obvious broken things that can mostly likely be fixed quickly and for which the impact can be quickly measured.

You are trying to find something with a clear purpose to show the power of actions taken through data.

One of my most beloved low hanging fruit for lead gen/ecommerce websites is to identify and improve the checkout abandonment rate .

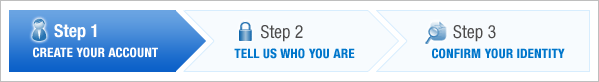

That would be measuring the efficiency of this process for Credit Karma:

For a lead gen/ecommerce website there is no faster way to improve the bottom line. The potential customer has already discovered us. They’ve survived our website. They’ve gone from consideration to purchase. Now, all that remains for us to make money is to get them through these three simple pages. Let’s make sure we do that! 100% of the time! (I love being aggressive in this case.)

This is directly tied to business purpose. It is absolutely focused on something important (getting the macro conversion). It is small (3 pages), and it is very well defined. And it is easily measureable (hello my dear funnel analysis, I’ve missed you!).

That is how an Analyst achieves glory. Through data. Powered by a clear purpose.

So five simple questions that help you focus on the end-to-end view of the business (Acquisition, Behavior, Outcome) without ever touching the data (except CI) and help you create your own Digital Marketing Measurement Model.

What I love more than anything else is that it forces you to become the Marketer for the couple hours you’ll spend on it. It forces you to think like a business owner for that time. It forces you to pull out any UI/UX chops you have.

It is rare that Analysts get to flex those muscles. It is important, though because I don’t know of a single Digital Analyst who has become great without flexing those muscles.

And now, my dear, you are ready to log into your web analytics tool!

But before you do that, I have one last parting gift for you…

Special Bonus: #6. Any technical notes I can make for the future (analytics or coding)?

As I’m clicking around I also like to make note of these things:

~ Randomly view source to see if the javascript tag for the web analytics tool is there. You just want to spot check if the tool is there (for GA just do View Page Source and Ctrl F and ga.js).

I do not encourage you to do to this until much, much later, but you can use a web analytics site audit tool for more thorough checking. But don’t do it now. Don’t get sucked into technical implementation hell just yet.

~ Things that might hinder SEO.

For example: Link text – is it descriptive? URL structures – are they clean (as on Credit Karma) or a jumble of technical gibberish (as on www.aeropostale.com )? Exit links – are they wrapped in javascript (can’t be read by search bots) or clean? How clean is the link structure? These and other such small things are both a task list and a sign of how savvy the company is when it comes to SEO.

~ When I click on various external ads (search, display, YouTube), I also take a quick peek at the URL window to check for campaign tracking parameters. So important to have them.

~ Make note of windows that pop up. If they are links to the company’s blog or their ecommerce/travel reservation/lead gen platform, is it on the same domain or a different domain?

Latter means tracking challenges, technical nightmares.

~ If they have an internal site search engine, and in this day and age it is criminal not to, then I do a quick search and see if my query shows up in the url stem. For example, on this blog it would look like this: http://www.kaushik.net/avinash/?s=segmentation

This would be awesome. The “s.” It means we can configure it in Analytics in two seconds (no IT begging involved) and start doing amazing internal site search analysis .

If the parameter does not exist… well, then IT begging will be mandatory. 🙂

Remember. You are not a technical implementer or a javascript tagger – two valuable roles. You are an Analyst. Your primary objective should be data analysis and finding insights. So the first five questions and the answers you’ll find are your focus area. The sixth is a gift you can give the javascript tagger/technical implementer in your company.

That’s it. My humble attempt at sharing with you everything I know about avoiding the single biggest mistake Digital Analysts/Marketers make: Execute their jobs without a clear business purpose.

If any of the above makes you feel that I hold data secondary and understanding what data is in service of first then I’ve succeed in my mission with this post.

As always, it’s your turn now.

What are the approaches you use to identify business purpose? Do you dive into the data first, and still find insights without doing the above mentioned five investigations? Is there a strategy outlined above that you feel works better than others? What are your favorite low hanging fruits to fix for a digital business?

Original POST

Standard reports stink. Custom reports rock!

Standard reports stink. Custom reports rock!